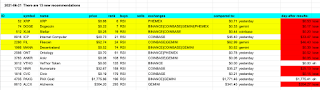

There are 29 e-coin buy-recommendations for 2021-06-30, most of which are TWK (Three White Knight https://www.investopedia.com/terms/t/three_white_soldiers.asp). This would indicate an upturn in the #cryptocurrency market. Of these, $FIL, $ALGO, $XTZ, and $OXT are on sale vis-à-vis my portfolio-holdings. Some good wins from yesterday's recommendations, but mostly saw losers. The 'market upturn' didn't stick, then.

Wednesday, June 30, 2021

Tuesday, June 29, 2021

2 e-coin buy-recommendations for 2021-06-29

Two e-coin buy-recommendations for 2021-06-29: $PAXG and $KEEP, neither of which are my jam, due to their below-100 rankings, so I'm not investing today. Hm. Both these recommendations (which I said I wasn't going for) have turned out to be day-after losers! #cryptocurrency BUT! ... [see next entry for recommendations for 2021-06-30]

Monday, June 28, 2021

Velocity: Stacked chart of $COMP

Here we see a Velocity stacked chart of $COMP supplies, reserves, and borrows using @flipsidecrypto data analytics (implemented by yours, truly). Note that you can scan the chart by bar for each value. You can also view the SQL that generated this chart.

Velocity: Cryptocurrency Data Analytics Tool

Velocity with @flipsidecrypto allows you to query and visualize $COMP, $LUNA, and $UNI #cryptocurrency. Here are $LUNA transactions

E-Coin recommendations for 2021-06-28

E-coin recommendations for 2021-06-28, 3 buy, 1 sell, but I'm going to sit today out, as I'm not hot on any of these, due to their rankings. 2 recommendations won, one didn't for the day-after analysis. #cryptocurrency

Sunday, June 27, 2021

3 e-coin buy-recommendations for 2021-06-27

3 e-coin buy-recommendations for 2021-06-27. Nothing is on sale for me in these recommendations, so I'm going to skip investing today. Again, the Bull #cryptocurrency market made all yesterday's buy-recommendations 'good.'

Saturday, June 26, 2021

E-coin recommendations for 2021-06-26

13 e-coin recommendations, 2 sell ($USDC and $SKL), 11 buy, for 2021-06-26. $BTC, $DOGE, and $UMA are on sale, vis-à-vis my portfolii. 8 good e-coin recommendations and 3 bad ones can be 'blamed' (mostly) on an upturn in the #cryptocurrency market.

Friday, June 25, 2021

3 e-coin buy-recommendations for 2021-06-25

Thursday, June 24, 2021

E-Coin Recommendations for 2021-06-24

3 buy- and 1 sell-recommendations for 2021-06-24. I don't see anything here that I'm going to buy today. The one sell-recommendation worked for this market downturn, but the buy recommendations didn't pan out. #cryptocurrency

2 e-coin buy-recommendations for 2021-06-23

Tuesday, June 22, 2021

17 e-coin buy-recommendations for 2021-06-22

There are 17 e-coin buy-recommendations for 2021-06-22 as the markets continue to fall. #cryptocrash #cryptocurrency Everything's on sale. What are of interest to me: $DOGE, $XRP, $XLM, $FIL, and $MANA As the market turned bullish, nearly all the recommendations worked. #cryptocurrency So, if I had bought the above recommendations, I would've made money hand-over-fist!

Monday, June 21, 2021

13 e-coin buy-recommendations for 2021-06-21

Sunday, June 20, 2021

13 e-coin buy-recommendations for 2021-06-20

13 e-coin buy-recommendations for 2021-06-20. $DOGE, $XML, $FIL, and $MANA are on sale, vis-à-vis my portfolii, but I am going to buy $100 of Ripple ($XRP) to start a position with that coin. The e-coin bear-market continues, making yesterday's recommendations not good, for the most part. 😐 #cryptocurrency

13 e-coin buy-recommendations for 2021-06-19

If I WERE (subjunctive case) on my game, these WOULD HAVE BEEN the e-coin buy-recommendations for 2021-06-19. Now they include day-after analysis. (The day-after analysis says: 'ick.') #cryptocurrency

Friday, June 18, 2021

19 e-coin buy-recommendations for 2021-06-18 in a bear market

19 e-coin buy-recommendations for 2021-06-18, but I'm going to sit this one out, as we are in a bear market. $MATIC, $XLM, and $UMA are all on sale vis-à-vis my portfolio, if you are looking. It turns out it wasn't a bad idea to sit it out 'yesterday': e-coin market was a bit of a mixed bag, and my recommendations didn't pan out. #cryptocurrency

Thursday, June 17, 2021

24 e-coin buy-recommendations for 2021-06-17

24 e-coin buy-recommendations for 2021-06-17, of which I find bargains in: $DOGE, $MATIC, $XLM, and $UMA (and would buy these, if I hadn't already hit my monthly e-coin budget, mutter, mutter). A downturn in the e-coin markets across the board leads to poor recommendation performance. #cryptocurrency

Wednesday, June 16, 2021

25 e-coin buy-recommendations for 2021-06-16

There are 25 (!!) e-coin buy-recommendations for 2021-06-16, 8 (!!) of which I'd love to buy (highlighted: $ETH, $DOGE, $ADA, $MATIC, $XML, $XTZ, $COMP, and $UMA are all on sale vis-à-vis my portfolio holdings), but I won't as I've met my #cryptocurrency budget for this month. Also added $OXT to the buy-recommendations for 2021-06-16. Mostly losers and 'ehs' but 3 winners from yesterday's recommendations. A downturn in the market gives me the sadz 😢

Tuesday, June 15, 2021

14 e-coin buy-recommendations for 2021-06-14 and day-after analysis

Day-after analysis: some wins, 2 eh's, and one loss on the 14 e-coin buy-recommendations from 2021-06-14. #cryptocurrency

12 e-coin buy-recommendations for 2021-06-15

12 e-coin buy-recommendations for 2021-06-15. I'm not buying anything, as I'm at budget for this month, but if I were, I would buy $XML as it's on sale, compared to my portfolio, and $WAVES as it has two recommendations from technical indicators. #cryptocurrency Day-later analysis shows for buy-recommendations yesterday show more lose and eh results than wins.

Wednesday, June 9, 2021

16 e-coin buy-recommendations for 2021-06-09

There are 16 e-coin BUY-recommendations for today. Of which I find $LTC on sale and WOULD buy $100 of on gemini (https://www.gemini.com/share/dy9ddwncl), however, I have met my e-coin buy budget reserve for this month, so I'll take a raincheck on that. 😢 #cryptocurrency

Tuesday, June 8, 2021

9 e-coin BUY-recommendations for 2021-06-08

9 e-coin BUY-recommendations for 2021-06-08. Of the 9 recommended, I find (at least) 5 to be 'on sale' and, of those, I am purchasing $100 of $BTC, $LINK, and $MANA today. #cryptocurrency

- ✅ Bought $100 $BTC at ~$31,948.31 per coin, today: $34,890.39 per coin. WIN

- ✅ Bought $100 $LINK at ~$22.73 per coin, today: $24.13 per coin. WIN

- ✅ Bought $100 $MANA at ~$0.67 per coin, today: $0.70 per coin. WIN

Monday, June 7, 2021

Bounties for Cryptocurrency work on Flipside

Bounties for completing #cryptocurrency work are offered at flipsidecrypto.com/bounties. Currently $COMP and $UNI have both 'easy' and 'hard' bounties available.

Binance's technical indicator analysis tools

Binance gives very sophisticated technical indicator analysis tools to entry-level investors. Here is $RVN's analysis. Go to their main menubar > Trade > Basic and you get these screens, included with your membership!

3 e-coin recommendations for 2021-06-07

There are 2 buy-recommendations, $ICP and $RVN, and 1 sell-recommendation, $LPT, for today. I'm not making any trades on today's buy-recommendations, as I fail to see support in both price and ranking. #cryptocurrency

Sunday, June 6, 2021

11 e-coin buy-recommendations for 2021-06-06

Wednesday, June 2, 2021

Staking Cryptocurrency: a way to create revenue from your E-Coins

Did you know that you could 'earn interest' on your cryptocurrencies? And, at a significantly higher interest rate than what you can earn from bank accounts, certificates of deposit (CDs), or bonds?

By staking your e-coins, -- that is to say, loaning out your e-coins at interest -- you can earn money from your cryptocurrency that is rolled back into your staked coins, 'growing' your money over time.

What is 'staking'? How do you do this? Which e-coins can be staked? Let's take a look at how to stake your e-coins.

What is 'staking'?

Do you know that anybody can loan anybody things? You lend somebody a book, they give it back, ... someday.

You hope.

You can also lend money. Some people think that only banks can lend money, but that's not true (never was), and is particularly not true nowadays with decentralized (crypto)currencies. Your dad can lend you $1000 for a down-payment on a house or car or to start a business, and you and he can have a formal or informal contract. "Dad, I'll pay you back over a year at 5% interest" is a very informal contract. Getting a loan from a bank or a mortgage company is a much more formal process, but follows the same contract: "I agree to pay back this loan of money on my house over the next 30 years at 3.375% interest. ... [with a lot more words thrown in there for good measure]." So, usually we think of 'loan accounts' (also called 'loans' or 'mortgages' (a loan you pay off until you die ('mort' means 'death' that you (en)gage in)) as something belonging to a bank.

Now, with decentralized currencies, anybody who owns e-coins can loan them out, and even loan them out at interest that begins accruing, sometimes immediately on owning these coins.

... But how do you stake your cryptocurrencies?

Besides having the complete freedom to loan out your e-coins to anyone (who, if they have a wallet, makes loaning them the e-coin easy to do and traceable), there are formal ways that exchanges permit you to stake your e-coins. Each exchange handles staking similarly, but each has their own particularities, so I will review four exchanges and how they allow to you stake certain e-coins.

CoinBase

With CoinBase, staking is automatic when you purchase the following coins into your coinbase wallet: $USDC at 0.15% (you read that correctly), $DAI at 2%, $XTZ at 4.63%, $ALGO at 6%, and $ATOM at 5%. This couldn't be easier, and this is how I got into staking e-coins.

Gemini

With Gemini, coin that you purchase is not automatically staked. You must go to the Earn-tab of your portfolio and determine how many of the coins that you own are to be staked. After you make your coin-purchase, it takes some days for Gemini to vet your purchase, but once vetted, and once you authorize your coins to be staked, they then can be loaned out to third parties and begin accruing interest.

Gemini makes it very clear, up front, the risks associated with staking, which may include you losing all your coins and getting nothing back. You have to read and sign a release before you can begin staking with Gemini, but once over that hurdle, Gemini allows over 30 different kinds of e-coins to be staked, which is the most kinds of coin that I've seen an exchange offer. Also, Gemini tends to offer higher interest rates of return than than of CoinBase. To get your coins out of the stake may take up to five business days.

Here are some of the top interest-paying coins that Gemini offers for you to stake:

Binance

Binance, like Gemini, requires you to be explicit if you want to stake coins. Binance differs from Gemini in that there are fewer coins it allows staking than Gemini, but, as compared to CoinBase, offers a much higher rate of return for the same coins (particularly $ATOM, $ALGO, and $XTZ). Also, unlike Gemini, Binance is explicit in requiring a minimum number of a type of coin before you can begin staking it.

Phemex

Phemex has only one coin you can stake: $USDT, a stablecoin, but it has a different approach to staking. Either you take the flexible approach where you add or withdraw any amount at any time for staking, and the return on that is at 7.5%, or, you can choose to lock your coins into staking for at least 7 days. When you do that, the rate of return is at 10%: the highest rate of return of any of the exchanges reviewed here.

Benefits/Risks

"Interest rates are low! You can't appreciate your capital with a traditional account!"

Both are valid statements, given today's markets, but taking a different approach, by staking e-coins, you can get a more-than-competitive rate of return.

What are the downsides to staking e-coins?

- Well, obviously, it's a loan. You can loan out your e-coin, but there are no guarantees that you'll get your principal back. The receiver defaults on the loan, and you are out your investment.

- But a non-obvious down-side is this: you stake your e-coin, you can't trade it. Would you be able to make (much) more in trading e-coin which tend to have much more percentage-price volatility than the interest you earn by staking? Very possibly: yes.