Liquidations

DOT

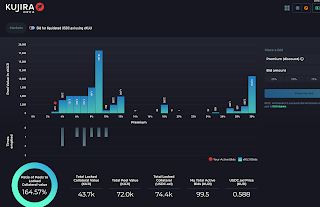

The FRIST! liquidation on @TeamKujira ORCA.

9.4 $DOT for 38.9 $USK, 21% premium

discount quote: $4.14, market price: $6.14

I sell back 7.9 $DOT on Manta, recouping the collateral + 8 $USK, and deposit the remaining 1.4 $DOT on Ghost.

WOOT!

I close my $STARS minting position and rebid for liquidated $DOT.

I think, eventually, I'm going to focus on a few bags, only, instead of whatever liquidations I receive.

KUJI

I claim liquidated $KUJI with $USK, YAY!

That was a good price, ... at the time, but with $KUJI now $1.67-per, I bought liquidated $KUJI at 200% its current price, which, they say, is no bueno.

$KUJI's not a good liquidation lever, so I cancel these bids.

I withdraw the $KUJI from @TeamKujira Ghost,

... with the eye of moving it all to my MENSA addy for pivot arbitrage, as arbitrating $KUJI with a pivot is much more profitable for me.

A bright light shineth, as a bid with $xPAXG.grv got me $KUJI at a 20% premium, or $KUJI at $1.08-per against a market price of $1.67.

Not much $KUJI, but that's okay, because the $PAXG.grv grew by Ghost's lending rate (the 'x-factor').

ROI: 24.13%; 187.42% APR

I turn right back around and swap that $KUJI back to PAXG.grv on Manta, ... essentially, this becomes an arb of $PAXG.grv

0.009 -> 0.0144 $PAXG.grv

... using liquidated $KUJI on ORCA as the pivot.

ROI: 50%, thankyousoverymuch. 😎🎉🎉🎉

LUNA

Okay, $LUNA. I claim liquidated $LUNA from $USK, however, at twice (today's) market price. Ugh.

9.7 $LUNA for 8.9 $USK, 'discount' price 92¢,

market price 54.6¢

ROI: -41.94%; -325.73% APR

I'd be sad, paying double-price for $LUNA, but ...

BUT! I claimed 114 $KUJI from 308 $xLUNA, this gives a discounted price for $KUJI to be $1.53 which is better than the market price of $1.67.

ROI: 8.05%; 52.48% APR

So! A gain arbitrating $KUJI with $xLUNA via ORCA liquidation bids.

Cool!

I also claim 50+ $LUNA from 30 $xUSDC.axl on @TeamKujira ORCA.

14% premium, 'discounted' quote: 63¢, market price 54.6¢

ROI: -14.04%; -63.26% APR

Still pricey. ☹️

MNTA

Next, $MNTA. I bid on liquidated $MNTA with $xUSDC.axl, and I got it, all right!

'discounted' quote: 70¢, market price: 31.8¢,

4% premium.

ROI: -55.42%; -430.41% APR

Bidding on liquidations with stables doesn't work out so well when volatile tokens are in free-fall. 🙄

I also withdraw my $MNTA from Ghost.

There's nothing to bid $xMNTA with on ORCA, anyway, and I'm better at arbitrating $MNTA on my MENSA addy with a pivot.

STARS

Meh.

Even a 27% premium did not protect my bid from the $STARS price-plummet.

Which is hilarious, as my $100 $STARS minting position wasn't liquidated, but my $1,500 $DOT minting position was.

Ouch.

I lend ALLES teh $STARS to @TeamKujira Ghost, then bid $USK with that lent $STARS.

So, when $STARS go back up, I'm rich, OR when a liquidation occurs, I'll get $USK at ~30% premium.

Either way: cool beans! 😊

PAXG

I turn right back around and swap that $KUJI back to PAXG.grv on Manta, ... essentially, this becomes an arb of $PAXG.grv

0.009 -> 0.0144 $PAXG.grv

... using liquidated $KUJI on ORCA as the pivot.

ROI: 50%, thankyousoverymuch. 😎🎉🎉🎉

Then I do all the $PAXG.grv things on @TeamKujira ORCA and Ghost: claiming liquidated $PAXG.grv on ORCA, lending it on Ghost, then bidding on liquidated $KUJI with that lent $PAXG.grv.

Oh, and #PSA: remember to activate your bids on @TeamKujira ORCA, as they no longer automatically activate, no matter if you select "automatically activate my bids with Sea Shanty" or not.

They just don't. So: activate your bids, or you get nothing, ever! 😤

ATOM

Not good news.

4 $ATOM from 45 $USK with the market price of $ATOM being $8-per now. Ick.

Fortunately, the market is cleared up to 9%, but we are no longer in alt-crypto Spring anymore, it appears. ☹️

ROI: -20.92%; -144.10% APR

OTOH, I do bid for liquidated $stATOM with $xKUJI,

... a 30% premium for 7.5 $stATOM? Sure. Why not!

Another meh-liquidation-claim of $ATOM from an $xUSDC.axl bid on @TeamKujira ORCA.

ROI: -6.90%; -30.71% APR

People are just too reckless with their $USK minting positions and they get liquidated at the slightest breeze in the air.

This is no good for me if the price plummets.

More $(st)ATOM; more meh.

3.2 $stATOM for 46 $USK, 'discount' price $13-per, but market price is $11.18, 3% premium.

Again, the premiums are now cleared up to 10%, but little did that help me with this liquidation fulfillment.

ROI: -17.48%; -120.38% APR

ORCA was supposed to be the market-downturn-protection-tool, making money when the markets tank.

This 🧵is showing the opposite: that during a bad bear, I can lose money on fulfilled liquidations.

Not stunningly happy with this news.

I'm taking a hard look at my ORCA-strategy.

Bed-time!

Okay, folks! I'm not done with the @TeamKujira ORCA liquidations: I still have more than several fulfilled liquidations to claim, BUT! It's time for this guy to fly to my beddy-bye!

BYE! 😴

No comments:

Post a Comment