Okay, let's explore the $ONE -> $stONE arbitration.

Is there one? How do you know? Then: what do you do if there is one?

So. Step one. Collect your $ONE from your 'infinite $ONE well' on @tranquil_fi. (I'll explain the term later.)

Next, let's understand $stONE. Go to @tranquil_fi $stONE page. You see it has a multiplier. What does this mean?

It means $stONE is worth 1.015, or whatever, times more than $ONE. Always, and the multiplier ALWAYS increases.

Remember this: $stONE is MORE than $ONE

Why is it important that $stONE is worth more than $ONE (ALWAYS)?

Because, sometimes, not all the time, but sometimes, the $ONE - $stONE peg goes kurfluffernutters, and you can swap, say, 100 $ONE for 101 or 102 $stONE.

"nbd," you say. Maybe. But let me explain.

To explain, let's open the 'Unstake'-tab on the $stONE @tranquil_fi page, or what I call the 'Burn'-tab ('burning' is a more general technique than unstaking).

What happens here is you burn $stONE to $ONE? This process takes about 7 days.

That's a GUARANTEED trade, folks

Okay, so, you've got the idea, right? You have $ONE, if you can trade that for MORE $stONE, you win.

That's called arbitration (well, one kind of arbitration), and it's as simple as that, so what remains is:

- The Mechanics (and Mike, too) lol

- What if there's no arb?

The Mechanics

How to see if there's an arb? Easy-peasy! Go to @SushiSwap and (simulate) a swap from $ONE to $stONE. If you get more $stONE out, you have the arb. SWAP! SWAP NOW! SWAP FOR ALL YOUR WORTH! HURRY!

I'm not kidding. Arbs can disappear in an instant.

Is there an arb now? Yes, 1014 $ONE -> 1015 $stONE. It's a little arb. A little, tiny arb. But do I take it?

YES!

In a heartbeat. Why? because usually the swap is something like 1000 $ONE -> 995ish $stONE.

You BET I'm taking this tiny arb. It's WAY better than negative

I can hear your disappointment: "All that work for 1 $ONE? That's 0.1%!"

No, it's not. Remember the multiplier? When you burn the $stONE to $ONE, you get back MORE $ONE!

How much more? For this trade:

81% annualized more.

Arbitrage computation.

Let's do this burn! Go to $stONE page on @tranquil_fi and open the 'Unstake' tab. Burn ('unstake') all 1015 $stONE, and you see the output: 1030.68 $ONE in 7(ish) days, or an 81% annualized gain.

Two words:

Dude. 😳

That's an 81% gain of $ONE yield, GUARANTEED.

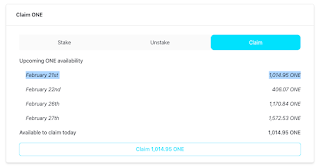

Let's check our burn. Go to the 'Claim'-tab. And, behold, you see what I call the 'infinite $ONE well':

I have a rotating pipeline of $ONE to be claimed, which I swap, then burn, then put right back on the pipeline.

I'm making 80%+ annualized gain on $ONE, infinitely 😎

The No-Arb Path

Okay, all the above is the 'Happy Path': when there's an arb on @SushiSwap. But what if there isn't an arb? Do we cry? (yes) Do we stomp our feet and throw tantrums? (yes)

But we can do something much more constructive, given we've set up ourselves for this eventuality.

This is the 'Sad Path': when there is no $ONE -> $stONE arb on @SushiSwap. To prepare for this eventuality, I've established $ONE and $stONE collateral positions on @tranquil_fi marketplace.

Why?

- Why not? 🤪 but seriously:

- Feeding the infinite $ONE well pipeline

With these position, when there's no arb, I make a daily call: do I borrow $stONE (yes: they're paying me to do so), or do I take $stONE out of collateral? (I've done that, too).

Either way (borrow or reduce collateral), I grab 1000 $stONE, and 7-day burn that to $ONE.

Why burn $stONE to $ONE, when $stONE is always worth more?

- The arbitrage, when it happens, is $ONE -> $stONE. I've NEVER seen $stONE -> $ONE arbitrage. I ALWAYS want $ONE at the ready to arb, AND they both collateralize at the same rate; and,

- If there IS no arb, I can use my $ONE bag as collateral to BORROW $stONE (which they pay in NET POSITIVE yields for me to borrow!) if I don't have $stONE collateral that I'm willing to part with.

A $ONE bag has no down-side.

Post script: I mentioned leverage, obliquely, a couple of times. You don't have to borrow $stONE to make this work. Ever. Just wait for the arb and accumulate an $stONE bag in reserve. You do you. I do leverage, and I'll cover leverage on @tranquil_fi in a future post.

Post-post script: alternatively, you can SWAP back to $ONE for an instant gain, albeit less. A conundrum.