Wednesday, August 31, 2022

Leveraging pop-quiz 2

Solution to Rust pop-quiz 3: modules

Solution to Rust pop-quiz 3, modules: utils.rs winter.rs

Q. There's no `mod` at the top of utils.rs. How does Rust know what module it is?

A. The filename, and the directive `mod utils;` in winter.rs tells Rust which module to import.

Daily #cryptocurrency income report, 2022-08-30

Daily #cryptocurrency income report, 2022-08-30: $40.10*

You're going to see more of these yields, and more often, now that the @BenqiFinance marketplaces are starting to grow.

*doesn't include auto-restaked yields nor s-token gains.

Daily Terra ('classic') report, 2022-08-31

Daily Terra ('classic') report, 2022-08-31:

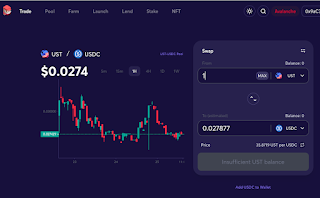

1 $USTC: 0.026027 $USDC

1.9M $LUNC: 11859.238942 $USTC

which is 303.534 $USDC off-chain, up 9.8% from yesterday

Tuesday, August 30, 2022

Rust pop-quiz 3: modules

- get_args() that gets the command line arguments

- get_nums() that gets the arguments as numbers.

Daily Terra ('classic') report, 2022-08-30

Monday, August 29, 2022

Daily Terra ('classic') report, 2022-08-29

Friday, August 26, 2022

Daily Terra ('classic') report, 2022-08-26

Fuzz.fi tour

Validator

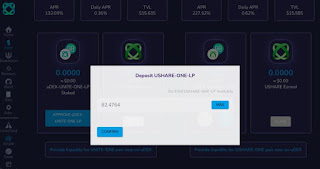

Why? @FuzzFinance provides a 1% incentive for stakers less than 10,000 $ONE and a 5% incentive for those who stake in 10,000 $ONE tiers.

DEX

I think it takes an Epoch for these boost incentives to show up, so: DON'T PANIC and CHILL OUT for an Epoch, okay?

Thursday, August 25, 2022

Leveraged APY quiz answers

These are the answers to the Leveraged APY pop-quiz.

1. How much is principal: $7,463.98

... you may have invested all the supply, but, at the end of the day the principal is what you have when you exit the protocol.

How was the distribution computed? We used the 'Pert'-formula.

new principal = principal * exp(rate x time)

'Pert'

Then we subtract the starting principal from the new principal to determine the distribution.

To compute the 'real APY' we use that distribution and the un-leveraged principal to compute the rate:

new principal = principal + distribution = $7,956.19

And plug everything into the Pert-formula, solving for rate to get real APY.

The real APY? 6.39%

D-mn. 😱😱😱

Now, recall, that @BenqiFinance reported my net APY to be 1.81%, but my REAL APY is 6.39%.

This, ladies and gentlemen, is the power of leverage: I'm getting paid distribution yields on borrowed assets, or, as I call it: "Other People's Money."

SWEET.

BONUS

Pop-quiz, à la Rust!

Write a Rust program that takes Supply, Borrow, and net APY as arguments and returns the real APY.

SPREADSHEET (Leverage tab)

Daily Terra ('classic') report, 2022-08-25

Daily Terra ('classic') report, 2022-08-25:

1 $USTC: 0.027917 $USDC

1.9M $LUNC: 7347.813153 $USTC

which is 197.915 $USDC off-chain, up 3.5% from yesterday 😍

Last day before Band protocol discontinues Terra Classic support for @mirror_protocol https://twitter.com/BandProtocol/status/1557680135222210560

Daily cryptocurrency income report, 2022-08-24

Daily #cryptocurrency income report, 2022-08-24: $23.71*

Another $20+ day; yay! 🎉 Sorely disappointed that the $ONE bleed-out is halving the value of returns all across Harmony.

*does not include auto-restaked yields nor x-token gains.