Liquid staking:

(Leveraged) Looping, and

the Danger (and opportunity!) of the Depeg.

Preparing for, then HOPING for, the worst.

Or: how I'm not getting any sleep tonight (again).

Real Talk with the el geophf.

Caveat Lector

Before we start, this, like my other HOWTO/pensées, hits heavy. No reason to be scared, however. If you don't understand something, learn the concepts.

I did.

If you still don't understand, ask. I bite: hard and ferociously, cuz I'm a mean ol' cuss, but you can still ask.

Concepts

So, I'll ask for you, because some people don't know.

- "What is liquid staking, el geophf, the munificent?"

Liquid staking. @stride_zone has a good description and a sine qua non in their

whitepaper.

Next concept

- "What is leveraged looping of liquid staking tokens, el geophf, the wizened?"

You callin' me old? 😤

Fair. 🤔

Funny how 'wizened,' or 'one who has obtained wisdom,' used to mean 'agèd person.'

Okay: back to the question. I've written

an article as my answer.

The Risk of Liquidation

You see in my article about liquid leveraged looping (λλλ, eheh 😅) that I point out that the s-token depeg is a possibility, in which case you're eff'd.

Are you?

Yes. Absolutely. The s-token depegs, and your entire supply collateral is liquidated to cover the borrow.

Eff'd.

And there's no way to stop this.

Remember Terra? I tried to bring in collateral, along with all the other wallets, to no avail.

BILLIONS of dollars, liquidated, and the network, my friends, was shut down to save ...

... absolutely nothing.

I hear tell people who looped $NearX when it depegged had a similar experience, ... orders of magnitude smaller, but still, when you lose money, the 'orders of magnitude' pale to your personal loss.

In all this (devastating) loss, I hear tell of people, and companies, who profited tremendously from depegs. One individual walked away with a 7-figure gain on the $UST-depeg.

Companies have set up multibillion-dollar hedges to destabilize then to profit from a depeg.

"VULTURES!" you scream.

"BLOOD-SUCKING OPPORTUNISTS!" you cry.

Here's the thing.

They are still here. And they are planning for the next depeg, right now.

Meaning: given the opportunity, a depeg WILL happen, and looped leveraged positions WILL be liquidated.

Strategies/Hedges

Okay, GIVEN that the depeg 'may' occur, there are several approach to take to this impending doom.

Let's go over each.

- "Leveraged looping is too risqué, but not in the good way. I'm makin' like a tree and getting outta heahe!"

Cowardice is one approach. And, if you opt-out on one of the most stable and high-yielding money-making strategies, then, ... well, we have nothing more to talk about.

- Insurance from a 'certified' ('certified' to be what??) third party

Here's why I detest this.

You give me your money.

That's stupid: what happens when the sh-t hits the fan?

I say: "Oh, insurance covers $327 of your loss. Here you go."

How do I know this?

Don't ask.

If you think getting paid a pittance for a crater-hole of financial loss is what pisses me off, you've missed my point.

You give YOUR MONEY to a THIRD PARTY?

How anti-DeFi can you get? 😤

Instead of paying somebody else, who doesn't care about you, why not be your OWN insurer?

Be your own insurer.

Look: people bet FOR the depeg, in some cases PROFITING millions of dollars.

Be one of those wise guyz. Bet FOR the depeg.

AND.

All the while, maintain your leveraged looped position.

That's making money on BOTH SIDES of the house, fam.

"Okay, Mr. Smarty-pants, ..." you say.

Thank you. Yes, I am: because I LISTEN TO and LEARN FROM my betters, then ACT ON this knowledge TO CREATE my own path.

That's a free #protip that I'm throwin' atcha, if'n you're catchin'.

Catch my drift?

HOWTO Hedge

"Yeah, so, anyway," you say: "Of COURSE I want to hedge. But how, man? HOW?"

I'd like to introduce you to a concept you've never heard of before:

The Liquidity Pool.

Now, before you snort at me derisively, claiming to know about liquidity pools, let's look at the use-case beyond providing liquidity for trade and thereby earning fees, yes?

Advanced liquidity pool investing involves this: when your token value DECREASES, the NUMBER of that token in your LP-pair INCREASES, thanks to the balancing-magic of the AMM/Automatic market maker.

Let's walk through a depeg-scenario to see how the s-token-token LP is a hedge.

Depeg Scenario

Let's say you have 5k $sAVAX supply on @BenqiFinance and borrow $AVAX against it.

Now, you're smart, see? So you have a 5k sAVAX-AVAX LP as hedge.

BOOM! $sAVAX depegs to $1.00 vs. $AVAX $20-per. You get liquidated and lose all your collateral: so only have $sAVAX collateral!

So, your @BenqiFinance-position is nullified.

What happens on the LP-side?

Your 5k sAVAX-AVAX LP IS STILL a 5k sAVAX-AVAX LP!

But, before it looked like this:

- 2,400 $sAVAX - 2,500 $AVAX

But after the depeg, it looks like this-...ish:

- 48,000 $sAVAX - 2,500 $AVAX: same value.

"48,000 $sAVAX?" you scoff, ... scoffingly. "What's the worth of that when $sAVAX is worth only $1.00?"

Here's its worth, and here's where you act, and act quickly:

- Draw down 50% of the LP. Now. Hurry.

That puts 24,000 $sAVAX and 1,200 $AVAX into your wallet.

Now that you have those assets-in-hand, you do the following.

- Supply a FRIKK'n

12,000 $sAVAX to @BenqiFinance

(sry: I misspoke.) That puts, not 12,000 $sAVAX, but a FRIKK'n 24,000 $sAVAX to @BenqiFinance.

So you're not up by a net-200%

You're up by a FRIKK'n net-400%

A FRIKK'N NET-400%, folks.

- Swap half the 1,200 $AVAX to $sAVAX and re-provide that liquidity to your sAVAX-AVAX LP.

- Wait. Wait for $sAVAX to regain peg. Wait patiently.

There are two outcome of your waiting:

- The peg never restores, and you have Harmony and Terra all over again. Welcome to the club. Hug a kitten. Smell some flowers. Don't kill yourself. Please.

It's a loss. Yes. It's just money. And money, at base, is nothing but Maya. माया

Or, like $NearX on @NEARProtocol:

- the s-token restore to peg.

But look at this:

You have your LP at 75%, once it rebalances.

But your @BenqiFinance supply is UP 120% 240%

And you have no borrow, so you're really up by more than 200%. 400%

You're up by more than 200% 400% from a depeg.

So. When somebody criticizes your liquid leveraged looped position (λλλ) (alles teh lurlz), saying: "What if the s-token depegs?"

Scream.

Scream in their faces: "O! G-D! PLEASE! PLEASE LET THE S-TOKEN DEPEG! PLEASE!"

Scream some sense into them.

For my sake at the very least.

Conclusion

What is the takeaway from all this, other than 'hedge your stake'?

It's this: it's the coward that listens the the crowd and cowers.

But you're not a coward: you're a trader. You're an investor. You don't let the crowd think for you: you think for yourself.

So when someone says: "but what about the depeg?" Don't respond: "Oh, yeah! The depeg. Gotta stay away from that. Too risky!"

No. Remember: you're an investor. Think, instead: "If the depeg happens, how do I set it up so that I profit from it?"

Always remember, the markets don't control your portfolio. They can't: they aren't the investor.

You are.

YOU control YOUR portfolio.

P.L. ('postlude')

I said 'Why I won't get any sleep tonight. Again.'

Here's why.

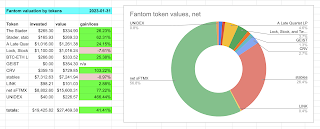

I have the s-token loops on @avalancheavax and @FantomFDN, but I don't have the s-token LP hedges in place.

Guess what I'm going to be doing all tonight, huh?

Welp. I hope YOU have a good night!