Sunday, July 31, 2022

Daily state-of-Terra (classic) report, 2022-07-31

Answer 2 to the supplying QI pop-quiz

Answer to Exercise 1 of Supplying QI pop quiz

Answer to Exercise 1 of Supplying QI pop quiz:

- 74% * $x = $21,000

- (1/74%) * 74% * $x = $21,000 * (1/74%)

- $x = $21,000 * (1/74%)

- $x = $21,000 * (1/74%) * (100% / 1) 'cancel %

- $x = $21,000 * 100 / 74

- $x = $28378.38ish

... before, when $AVAX collateral factor was 70%, the answer was $30k, so: ... cool!

Saturday, July 30, 2022

Daily state-of-Terra (classic) report, 2022-07-30

POP QUIZ: Supplying QI

- $AVAX is lookin' good rn.

- $QI ... never has?

- Well, we can swap for it, swapping $21k $AVAX for $21k $QI, on, say, @traderjoe_xyz or @pangolindex.

- Or: we can supply $x of $AVAX to borrow $21k, but not of $QI (you can't borrow $QI on @BenqiFinance), but another token, say, ... $AVAX? (or the token of your choice)

- 50% SWAP to $QI as @BenqiFinance SUPPLY

- the other 50% becomes QI-AVAX LP as @BenqiFinance STAKE

Avalanche: QI-yield experiment

Hello? Please sign me up! *geophf enqueues.

@BenqiFinance very kindly tells you the amounts of the QI-AVAX LP you have staked, and, momentarily, you see your accumulated $QI-yields.

Even me. Even you.

If I can do this thing, starting with nothing, you can do this thing, too, by gum!

'Feelz'

- angry mobs don't matter

- Tse's 'back to the drawing board' doesn't matter. He floated proposals to 'fix this'; he'll float new ones.

Friday, July 29, 2022

Daily state-of-Terra (classic) report, 2022-07-29

Thursday, July 28, 2022

Daily state-of-Terra (classic) report, 2022-07-28

Harmony AAVE daily reports discontinued

Wednesday, July 27, 2022

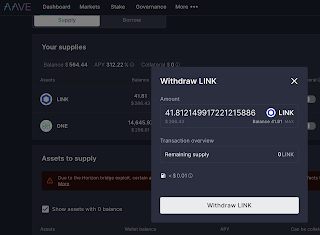

Daily Aave LINK self-funding experiment report, 2022-07-27

Daily @AaveAave $LINK self-funding experiment report, 2022-07-27:

Day 14

Invested: 39.29066368 $LINK

Goal: 74.36176567 $LINK

balance: 41.81212842 $LINK

APY% (measured): 447.30%

$LINK earned/day (average): 0.1743310786

Self-funded in: 180.7 days

Daily state-of-Terra (classic) report, 2022-07-27

Harmony hack numbers

The $1USDC de-peg is obvious in this light. But this also shows which tokens hold their values across blockchains. Source, linked proposal in https://twitter.com/harmonyprotocol/status/1552097233692069888

Tuesday, July 26, 2022

Daily state-of-Terra (classic) report, 2022-07-26

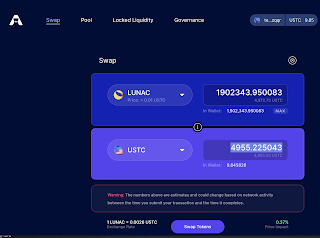

Daily state-of-Terra (classic) report, 2022-07-26:

1 $USTC: 0.042 $USDC

1.9M $LUNC: 5116.8 $USTC

... which is 167 $USDC off-chain, down 7.5% from yesterday

Really? Ouch!

Perspective

I complain that I have 'only' $167 worth of $LUNC on Terra Classic, but I need to have perspective.

- I bought 4M $LUNC for $200.00 after the crash.

- 2M I invested into @mirror_protocol which is now 53k $USTC, now worth $1,600! WOW!

- The other 1.9M $LUNC is worth $167.

I win. 😎

Daily Aave LINK self-funding experiment report, 2022-07-26

Daily @AaveAave $LINK self-funding experiment report, 2022-07-26:

Day 13

Invested: 39.29066368 $LINK

Goal: 74.36176567 $LINK

balance: 41.5569677 $LINK

APY% (measured): 463.48%

$LINK earned/day (average): 0.1743310786

Self-funded in: 188.1752711 days

Monday, July 25, 2022

Bonus-bonus answer to Benqi Pop-quiz

- $AVAX reinvestment annual returns were: $26,284.54

- $sAVAX conversion then reinvestment annual returns were: $26,323.95