Let's talk about 'IL'/impermanent loss for a minute. Let's talk about what it means to me, and what it means to you, and how the FUD around IL is maybe holding you back, okay?

First off the definition from Binance, because why not?

I'm going to use some harsh language in this thread. Why? It's because I love you. But here's the thing: I will be deconstructing something you hold near and dear, so, if you don't agree with me: that's fine. I'm just an old curmudgeon. You don't have to listen to me.

So, let's deal with the FUD about IL first, shall we, so I can lose 90% of you to screaming rhetoric from holy wars.

The FUD, insofar as I can see, is this: "I'll lose money because of IL."

Why is this a fear? Let's talk about that.

"I'll lose money because of IL" is an unnecessary fear. Why?

Because you'll lose money in crypto. Period.

Get over it.

Until you realize you'll lose money in crypto, and plan accordingly, you'll ... lose money in crypto. A lot of it, and it'll hurt. A lot.

We have to pause here, because some will ask: "Okay, how do I plan accordingly, then?" So let's talk about plans.

What's your plan? Can you outline it for me? What's your approach? How is it different than mine? Because it is different than mine.

Write your plan down.

And that's how you learn to plan accordingly: know your plan, and stick to it. So, let's talk about plans I've seen.

- IMMA APE IN BECOZ SUM BRUV ON INTERNETz SAID DIS MEME COIN IS MOONIN'!

Okay, that's... a plan. That works, ... sometimes. And if that's you: you do you.

But if that's your plan, we, you and I, have nothing further to discuss. Why? Does your plan work? Maybe? But what do you learn from it? How is that sustainable?

Let's talk about sustainable plans. There are lots of them, so I'll talk about mine, okay?

Okay: my plan.

I put $100 in something. I let that do its thing for a couple of weeks. If it doesn't work, I lose $100.

Boo. hoo.

If it works, I feed it a bit more, week after week, until it finds a spot in my portfolio.

That's how I started with @DefiKingdoms: $100.00

$22k from an initial $100 investment? So that plan works, right?

On the success-side, yes. But also on the fail-side, how?

The fail-safe of my plan is: 'Boo. hoo.'

$100 back then was 1/20 of my money.

All my money.

But this means I could afford to lose $100.

Only invest what you can afford to lose.

But how does the fail-safe help me multiply successes?

When something's working, I lean into it.

You can't lean into an investment if you've already aped in with all you've got. But my investment plan is to put $100 in. Which means I can add $100, time and again.

And that, too, is my plan, which I learned from building adaptive systems:

Feed successes; starve failures.

This is a very emotionless (dare I say: "Logical"?), measured approach. I lean into what works, and ignore what doesn't.

So far, this plan is doing okay.

What, again, does all this have to do with Impermanent Loss?

Nothing, but also everything.

- Nothing because IL is a very dry, boring, measurement.

- Everything, because I've made $80k net profit from $20K invested, more than 90% of that is from LPs.

Let that sink in.

So, somehow, I've made LPs/Liquidity Pools work for me, despite this boogeyman, IL/Impermanent Loss. How? Why? What? Who? ('Who' is moiself, so that one's easy to answer).

But that's because I have a plan, and I stick to it, regardless of what all the FUD says.

Okay, we've talked about FUD; we've talked about plans. Now, let's talk about LPs and IL, specifically: if you're concerned about IL in LPs, it's probably because:

- you're investing in the wrong LP

- you're investing wrong in LPs

- you're just plain wrong.

Let's talk.

Investing in the Wrong LP

Now, you can read my position on IL: it's stupid and it's holding you back. But that doesn't mean I don't consider IL. I just don't invest in LPs where IL is a concern to me.

Where is IL a concern to me? Where I value the coin more highly than I value providing liquidity.

A vivid example is the nLUNA-PSI LP. @NexusProtocol $PSI followed other protocol tokens on Terra: a path straight down to Hell: do not pass go, do not collect $200

I put LUNA into that LP, enticed by those sweet yields, then watched my LUNA disappear with PSI's drop.

The nLUNA-PSI LP is the WRONG LP: I care, deeply, about my LUNA, I don't care about PSI yield that now cannot buy me even a doppio.

What, then, is the right LP? So many, but here are two characteristics:

- it pays yields I care about

- each side of the LP pair is SOLID

So, yeah. Let's go with the @DefiKingdoms-example. The top three LPs are paying $5+ in $JEWEL yield per $100 invested...

... PER WEEK. 😱

And look at the pairings of the top three: $ONE, $MATIC, $FTM.

The right LPs: pay yields I care about with solid protocol tokens.

Investing in LPs Wrong

We talked about Wrong LP (and counterexampled with Right LP). Now, let's talk about investing in LPs at all, and why you're doing it wrong.

If you're checking the price of your token in an LP, you need to check yourself.

You put your token in an LP to PROVIDE LIQUIDITY!

What does 'provide liquidity' mean? If you don't know what that means (you don't), then you shouldn't invest in LPs.

When I provide liquidity, I am giving my coins away for someone else to sell and someone else to buy. If the price goes up, SOMEONE ELSE is happy. Not me.

So, stop it! Just stop looking at the price, and stop looking at: "I lost 3 $JEWEL today in my LP!"

You WANT to lose 3 $JEWEL in your LP! That means exchanges happened. That means you're getting paid: you're a liquidity (currency) provider. That means your LP IS WORKING!

"But I don't want to lose my $JEWEL!" you cry!

What did I say about stopping that? But you won't because you don't listen. You only hear what you want to hear, and you'll learn nothing until you do stop it. There's nothing for it.

Learning is stopping and listening.

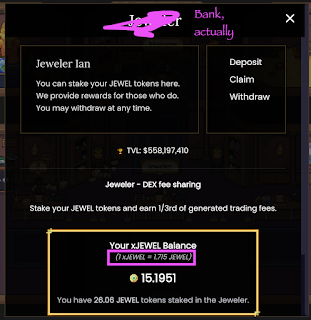

So, you don't want to lose your $JEWEL. Okay. Have it your way. Single stake your $JEWEL in the bank for $xJEWEL at a 1.7 multiplier. That means 100 $JEWEL staked 7 months ago is now 170 $JEWEL. Yay. Go you. You saved yourself from that icky IL.

(here it comes).

You saw what I made in @DefiKingdoms, right? 2,750 $JEWEL, some I have mined. I made that ALL from LPs, from my initial investment of 100 $JEWEL.

Your fear of IL has a cost: 2,580 $JEWEL, or a 95% unrealized gain, to be exact.

Don't invest in LPs. They have IL. 🙄

So, that covers how and why you're investing in LPs wrong. KNOW what the instrument does and HOW it does it, THEN you can profit by this knowledge.

So: first two points covered, now let's cover the last point.

You're Wrong

Now, let's talk about why you're wrong, okay?

"I'm wrong?" you ask, stunned.

Yuep.

Say it: "impermanent loss."

Everybody says it like it's one word. And now, it is, ipso facto: "IL." What does that even mean? Nobody knows anymore, because TLAs have immortalized this FUD.

Words have meaning, folks.

Words have meaning.

It's called 'impermanent loss' for a reason.

If you don't sell your LP, you don't take the loss.

What?

When the LP rebalances when its pair catches up (BECAUSE IT'S A SOLID TOKEN! DYOR, D-MNIT!), then you get your tokens back.

Also, your loss is your gain.

What?

Your loss is your gain.

In an A-B LP, when you lose A, B comes in, because it's, like, an exchange, and stuff, duh. So, every LP you go into you want A, but you also want B, BECAUSE BOTH ARE SOLID! AND A GAIN OF EITHER IS YOUR GAIN, DUMMY!

Sheesh. Kids these days.

But most especially, you want the A-B / B-A exchanges, because that's why you provided liquidity in the first place, right?

And that's what LPs are for, and that's why IL doesn't matter. Not to me, and not to you.

Thanks. I'll be here 'til Tuesday. Try to veal. 😘

No comments:

Post a Comment