Okay!

I have liquidity accumulated from the last few days, because where to invest?

I am now not starved for choice. Let's review some by blockchain:

Avalanche

First up: home base, or Good Ol' Avalanche.

I see two investment opportunities for me here.

- @GMX_IO $GMX at 10%ish that also creates an amp-token for my $GLP investment.

- @traderjoe_xyz sAVAX-AVAX LP, yielding $QI at 6% and $JOE at 0%ish percent.

Tron

Next, Tron.

So, @defi_sunio. What to say?

- Because why? Because USDT-USDD LPs can make up to 50-60% with stable coin yields.

With a guaranteed 1-1 SWAP to other stables (c.f.: PSM 'Peg Stability Module')

Solana

Next, leveraged LPs and lending on Solana, specifically @Francium_Defi.

Those of you familiar with @mars_protocol on ol' Terra, – and, WHEN ARE YOU GOING LIVE, HUH??? – will be familiar with this protocol.

I have concerns, however: the no-IL LP stSOL-SOL yields nearly nothing.

So: does that mean I build a position in the @Francium_Defi money marketplace?

$ZBC has a page on @coinbase, of all places,

With $ZBC $0.01 price (sh-tcoin red flag) and price-chart characteristic, it certainly looks like another $FUZZ or $QI. I don't have time to manage sh-tcoins. I need to invest in tokens that yield well and retain their value over time.

Cardano/Milkomeda

Next, Cardano-...ish? 'Milkomeda' an L2-chain associated with Cardano and other L1-chains.

There are problems for me. @RavcubeFinance is a tombstone protocol, and, historical, with the pegged asset still in play, it's very hard to return to above peg when the token's value falls below peg. So: are they doing a good job returning to peg?

I can afford to wait and see.

The second problem is this:

The tombstone LPs are managed by @OccamFi.

Hm.

Digging deeper I see this: yields unlock at $250M TVL.

Which means what for $RAV / $RSHARE? I don't know, but I don't like the association with a protocol that locks away their token for ... forever? and then flooding the market at a 5k% clip with this locked token.

These are two serious issues. I'm fine sitting this one out.

Okay, that summarizes the options, I think. Did I miss any bangers you're invested in and love?

The Plan

So, what's the plan, then?

Well, the closer to home, the better. Why?

- I know nothing of Tron blockchain, so murky waters there. I guess it's time for me to learn, though, eh? I'll invest $400 into their 2 stable LPs, and another $200 for $TRX lubrication and $SUN locks.

- I'll stake 100 $KUJI with @BlackWhaleDeFi on Kujira, but then there are the most active order books that I have no stake in: axlUSDCUSK and KUJIaxlUSDC. I'll put some bids into those order books.

- The remaining liquidity will go to fund the sAVAX-AVAX LP on @traderjoe_xyz, earning 6ish%.

- start earning income-replacing yields?

- grow my principal stake?

Let's do this.

Tron.

Getting liquidity to Tron is easy with the http://swap.transit.finance/#/ swap-bridge, but there is something interesting to notice.

Look at the swap rates for various tiers of $USDT:

10 -> 9.17100 -> 98.9550 -> 547.55 (or 0.9955454545)1000 -> 996.2

Different efficacies for LPs is a known problem, but I've always seen a swap-rate be relatively consistent, that is, for well-funded LPs. But these bands are very stark in their different swap-rates.

But even at 1000 $USDT, I'm losing 4 of them.

Okay, $USDT-swap-curve noted. But before I transfer $USDT-liquidity to Tron, I'll need some $TRX for transaction on that blockchain. Which is the better swap, however: $AVAX or $USDT?

It turns out the $USDT-swap is better. Good. So, I'll convert to 600 $USDT, bridge most of that, and swap-bridge to some $TRX to start my adventure on the Tron network.

Okay, so now I'm on Tron network with the purpose of investing in the high-yielding stable LPs.

Before I do that, I LOCK some $SUN by, well, first SWAPPING to $SUN from bridged $USDT on @defi_sunio.

Goodbye, 140 $USDT. 🙄

So, am I ready to invest into these stable LPs? Not quite yet: I need $USDD.

The swap from $USDT is at a slight disadvantage,

And now I see how a stable LP gets such JUICY APYs ...

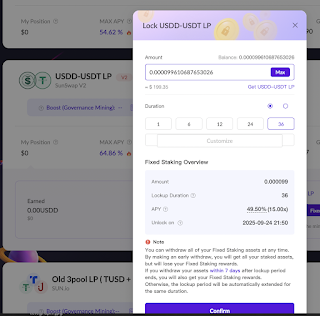

Okay. I've come this far. Let's see what a 36-month lock feels like.

This concludes the Tron-portion of my investing-foray.

How do I feel about Tron?

Hm: old-fashioned. I burned through an awful lot of $TRX to set up these accounts that I'll never see again, ... and, ... can I add liquidity to them without incurring penalties or extensions? Hm.

Kujira

Let's fund Kujira blockchain projects.

I have an article on how to do this: http://logicalgraphs.blogspot.com/2022/10/fin-kujira-order-book.html

So, I'll jump in.

- I swap $DAI.e -> $USDC -> $axlUSDC on @yieldyak_ and @CurveFinance

- I bridge the $axlUSDC to Kujira, using BLUE.

- I place a limit order for $KUJI on FIN

While I'm waiting for that $KUJI order to be (completely) fulfilled,

- I place both buy and sell limit orders for $KUJI on KUJIaxlUSDC, the largest @TeamKujira Order Book by volume

- I also place both buy and sell limit orders for $axlUSDC on axlUSDCUSK Order book.

This concludes my investing on Kujira for today.

How do I feel about @TeamKujira?

Hyper-responsive. Hyper-modern, ... and now I'm starting to catch the HYPE surrounding this blockchain.

Will Kujira make me rich?

Maybe. Maybe. We shall see.

Avalanche

This leaves the rest of the investment liquidity for the Avalanche blockchain.

First: I collect the @BenqiFinance $QI- and $AVAX-yields

Okay, now let's disburse the liquidity.

Why $BTC.b? @GMX_IO discounts fees for tokens they want to absorb into $GLP.

I also swap for $250 worth of $GMX on @GMX_IO

I convert the remaining liquidity to $AVAX, then half of that to $sAVAX to stake as sAVAX-AVAX LP on @traderjoe_xyz.

The $JOE-yields I stake, yielding $USDC at ~6%.

- 50% is swapped to $sAVAX then supplied on @BenqiFinance

- 50% is supplied as $QI to the @BenqiFinance marketplace.

This brings us to the lay of the land on Avalanche:

- 61% in $sAVAX supply on @BenqiFinance

- 35% on the sAVAX-AVAX LP staked on @traderjoe_xyz

- GMX a distant, but perhaps significant, third

Net APY on @BenqiFinance: 1.91%

Computed Real APY on principal: 8.75%

https://github.com/logicalgraphs/crypto-n-rust/blob/main/src/ch05/apy_goal.rs

To make $1000/day in yields, I need:

$4,173,670.5 in principal or 251,577.48 $sAVAX

$19,109,948 in leverage or 1,151,895.6 $sAVAX

I am at 0.61% principal goal and 0.65% leverage goal

I am going to improve the report (PT) to include APYs and assets from @traderjoe_xyz and @GMX_IO.

But not tonight. Tonight, I sleep.

Good night, fam. I love you.

No comments:

Post a Comment