Let's do the ETHBTC-THANG!

I record the $ADA price from @Indigo_protocol and the $ETH and $BTC prices from @Levana_protocol.

The EMA20 indicators for $ADA show no swap, either way for { $ETH, $BTC } <-> $ADA.

My SPREADSHEETSZORXEN! confirms that nothing is traded, { $ETH, $BTC } <-> $ADA, either way.

So that's a nice confirmation.

2024-01-30 Indigo portfolio

incept date: 2023-07-27

0.01228 $iBTC: $534.06

0.7104 $iETH: $1,681.43

2,643.25 $iUSD: $2,643.25

804 $ADA: $418.29

total fees $63.63

total yields $606.31

net yields $542.68

23.72% APY

invested: $4,465.58

value: $5,277.04

ROI: 8.80% / 17.19% APR

2024-01-30 ETHBTC-THANG! Day 247

The ETHBTC-THANG!

- swap 0.00261 $BTC

After swap:

ETH: 3.98942 / BTC: 0.0940

Total: $13,530.19 / TVL EMA-20: $12,559.09

n.b.: TVL EMA-20 indicates that ETHBTC, itself, is cruising!

ROI: 2.29% / 3.39% APR

BTC -> ETH trade

Okay, I withdraw 0.00261 from @TeamKujira GHOST (~$110).

So, to buy $ETH, do I do a set of swaps on FIN, or lease the $ETH with the $BTC on @NolusProtocol?

How do I answer this question?

If I look at the ETH/USD EMA20, $ETH is at a local high:

...so I buy via swap instead of lease.

Rest assured: when I do see a leasing opportunity on @NolusProtocol, I'll keep y'all in the loop. I might do a video-tutorial on leasing $ETH or $BTC: identifying why I'm leasing and how I lease $ETH from $BTC collateral, or vice-versa.

wETH arb with wstETH

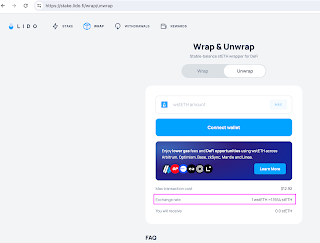

One final thing: I'm arb'n my $wETH on @TeamKujira FIN by swapping $wETH to $wstETH and back.

I buy $wstETH lower than the exchange rate of 1.1554 (from @LidoFinance)

No comments:

Post a Comment