Okay, I talked about @anchor_protocol: http://logicalgraphs.blogspot.com/2022/10/anchor-less-on-terra-classic.html

Now let's talk about @mirror_protocol.

"Is @mirror_protocol even viable, geophf?"

Let's take a look.

Recall I wrote an article yesterday about Mirror's current lock'd farm-situation, and how to get around that ... sometimes.

Full disclosure.

I love @mirror_protocol. I love Mirror more than I love ... UR MOM!

And since I'm older than your mom, that makes me ... yes, say it: YOUR DADDY!

WHOZ UR DADDY!? ME! IM UR DADDY!

So deal.

... I'm glad that didn't get weird. 🙄

And that is a geophf-way of saying this:

If you were to ask: "geophf, is @mirror_protocol better than sliced bread?"

My answer will be: "You slice bread?"

I'm French, after all. Slicing bread is anathema.

Also, I'm going to Oktoberfest in D.C.

TIL I'm German. Well, okay, then.

So, I'm going to cut this thread off, mid-stream, and come back to it, hours and hours and much more endrunkified, later.

kthxbaifam

Okay, but @mirror_protocol: is it the real-deal, still, or what? I need to prove this out to myself, because you believe in me, because I use maths, and stuff.

geophf-wizardry with the spreadsheets, and all that.

(Yes, I'm back)

(Yes, I tweet better when I've had a few drinks).

Okay: is @mirror_protocol fo' realz?

Yes, ... and no.

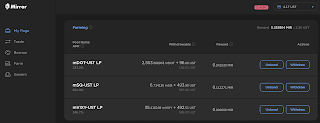

First, let's calculate REAL APYs and see if they match APYs as advertised.

I took out an mDOT-UST LP yesterday advertising 223% APY.

My spreadsheet shows: 218.14%

But, on that self-same spreadsheet that verifies the APY, you see the APR of negative gazillion.

What's going on there?

$mDOT, along with $mETH and $mBTC, is, to used the technical term: effed.

What do I mean "eff'd"?

During the LUNA v2.0 launch, some ... person used the new LUNA price to 'borrow' millions of dollars of these assets with the devalued LUNA as collateral, walking away with these mirrored assets for basically nothing, draining these tokens of all value.

What does that mean for me, for you, and for the APR?

It means if you buy these assets, you're buying nothing, just emptied tokens.

When you try to sell these assets, that's exactly what you'll get in the swap: nothing.

So, ... why buy assets with this horrendous slippage?

Why did I buy $mDOT?

Because I CAN'T buy mirrored assets on Mirror. Mirror has locked trading at the contract level.

If you haven't heard, the Band Oracle shut down, so any trade is now wrong.

It was wrong before... Band sucks, but it's wrongER now, so Mirror cut the chord.

Invest in Mirror?

So: APY vs APR. The trade-off on @mirror_protocol is this:

You CAN buy worthless assets to farm $MIR for a good (one of the best in the world, actually) REAL APY

(where else can you say that?)

But, in so doing, your investment? it just got rekt; therefore the negative APR.

So: do I recommend investing in @mirror_protocol?

Yes and no.

I DON'T recommend it if you want ANY of your investment money back, at all, ever.

Get me?

I DO recommend it ... cautiously, ... if you want yields that HAVE retained their value and MAY do so going forward.

The Plan

How, then, am I, the el geophf, going to invest into @mirror_protocol?

- cautiously, with my eyes open.

- with no money.

- in small, experimental increments.

What do I mean by this?

1. I mean, that's how you should invest anything any time, eh?

... unless you're the Joker and can use piles of money like slide and then burn it to [checks notes] "send a message."

Or like Harley and Ivy and throw money around before using it as a mattress.

I'm not there yet.

2. "invest nothing"??? What do I mean by that.

Well, lookie here: I bought 1.9M $LUNC for $100 at $LUNC atl. It's now worth ~$500.

But I've done this before, see? I swapped some $LUNC for $UST to fund @mirror_protocol before Band cut the chord, ... do you know what happened?

This is what happened: that initial funding, that was either 10k $UST or 25k $UST from swapped $LUNC (I don't remember which, it was too many traumas ago, smh) grew to 56k $UST when I closed my @mirror_protocol positions.

That's growing my money faster than HODL'n dormant $LUNC.

Is that going to happen again this time?

No idea. $LUNC may sky; @mirror_protocol may die.

I don't know why

She swallowed the fly.

That's why 1. and 2. apply: I'm going in cautiously, and I'm going in with converted $LUNC, that is: nothing.

So, 3. small, experimental chunks.

1. Let's go in with 1000 $UST, buy and asset, pair it then farm it on @mirror_protocol.

1000 $UST is $30. That's small.

Let's repeat this until I can't buy an asset to farm, so I'll be left with 1000 $UST, whaa, boo-hoo.

Okay, our first $LUNC - $UST swap.

Let's see the swaps across the DEXen.

Loop was the cheapest, but Loop also doesn't allow the swap.

F.

No problem.

Terra, broken, beaten down Terra, has taught me to be both flexible and creative.

Chicks dig that, I'm told. 😎

The swap on @terraswap_io worked; I went with that.

Okay! Now I have 1000 (fake) $UST (*depegged, actually) from 94k (fake) $LUNA.

Wat do?

We go to the farms, sort by LONG APY, then look for an asset we can buy, somewhere, anywhere.

No $mVIXY

Wait, ... am I doing this wrongly?

Narrator: yes.

me: thx, fam, luvu. 🙄

Narrator: luvu2, m8. 😊

The Narrator was correct.

The RIGHT way to go about this is

1. 'zap' the 1000 $UST into the @SpecProtocol vault

... lather ...

... rinse ...

Oops! I didn't withdraw that as an LP!

That's easy to fix: redeposit the assets then re-withdraw as an LP, ... easy-peasies!

No comments:

Post a Comment