I'm closing my @Alpha_HomoraV2 positions.

Avalanche

- $802 wETH.e-AVAX LP, I received:

34.4 $AVAX, 40% ROI

0.3 $ETH, 18% ROI

- $802 USDC.e-AVAX LP, I received:

32.9 $AVAX, 33.6% ROI

475 $USDC.e, 18.4% ROI

and 527 $PNG

That is amazing!

Closing out these positions gives me $PNG, $AVAX, $wETH.e, and $USDC.e.

- The $PNG I swap right away to $AVAX on @pangolindex

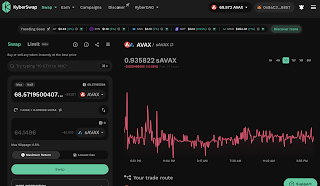

- The $AVAX I swap to $sAVAX on @KyberNetwork then supply to @BenqiFinance so I can borrow for experiments later ... borrowing some $AVAX now ...

The reason I borrow the $AVAX is to provide liquidity to the sAVAX-AVAX LP on @traderjoe_xyz as hedge against the sAVAX loop on @BenqiFinance.

When I stake to the sAVAX-AVAX LP, I (reflexively) harvest the $QI-yields, SO! I go to @BenqiFinance and harvest the $QI-yields there.

Then I convert the $QI-yields to $AVAX on @pangolindex

Meanwhile, there are the $ETH- and the $USDC-residuals from the @Alpha_HomoraV2 LPs to deal with. I bridge both over to @arbitrum (you'll find out why).

With the $AVAX-from-QI-yields and the $AVAX-yields from @GMX_IO, I reinvest into @GMX_IO. First, $GMX, which I simply swap for on @traderjoe_xyz, then stake on @GMX_IO.

When I go to purchase (and stake) $GLP, I exclaim, because LOOK at the fee-discount for $ETH!

So, I swap my $AVAX for $wETH.e on @traderjoe_xyz, then buy, which auto(magic)ally stakes, $GLP on @GMX_IO with that $ETH.

No comments:

Post a Comment