Let's go to @FantomFDN, fam.

There are some interesting things going on on this blockchain, folks, starting with @GeistFinance

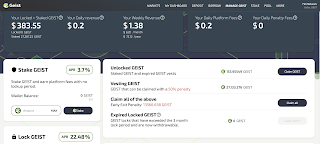

Geist

Now, it gets a bit more interesting when we look at $MIM.

The 'problem' of $MIM hasn't really manifested itself as a problem, yet.

Is that a depeg?

But the incentives for borrowing $MIM are high, AND the borrow rate is low.

NOICE!

In fact, not only $MIM is incentivized higher than the borrow rate, but also $CRV and $LINK are, as well.

What does that mean?

That means @GeistFinance is PAYING ME in $GEIST to borrow.

Am I borrowing?

Yes. Yes, I am.

But okay: $GEIST yields. Why do I care? Why should you?

About the $GEIST yields?

I don't.

I care about what the $GEIST yields, themselves, yield.

And those are the supply tokens on the @GeistFinance money market, folks:

$ETH, $FTM, $USDC, $MIM, $CRV, $LINK, $DAI, and $GEIST

I've certainly got mine!

So, as you see, as soon as my $GEIST tokens vest (which takes 3 months), ...

Granary

Next, let's go to @GranaryFinance, and Holy Buckwheat Cakes, Batman! did $OATH, one of the yield tokens, just triple in price???

This allows me to invest $OATH into one of the cute LPs on @beethoven_x, after I collect the yields on @GranaryFinance.

Okay, so I go over to @beethoven_x.

Beethoven

The first thing to notice: the Spotie Oatie-LP is not 50/50 $OATH and $wETH, but heavily leaning to $OATH.

But, before I do that, I still have the $SD-yields to disburse. I invest them into the triple-LP on @beethoven_x, first swapping to get the desired balance of coins needed.

I unstake and withdraw the LP as $sFTMX, destined for @GranaryFinance.

The unstake releases some $SD-yields.

Wheeeeee!

Once again, I redistribute (swap) and reinvest my $SD-yields into the triple-LP.

Pretty soon I'm going to run out of ball jars and places to bury all this money in my back-...yaärhd! Ya know what I'mma sayin'? 😎

My LP farms settle thusly on @beethoven_x:

Granary, part deux

Let's return to @GranaryFinance.

Dear @GranaryFinance,

I get the following error when I try to borrow 8,000 $FTM, fully covered by my collateral $sFTMX:

[ethjs-query] while formatting outputs from RPC '{"value":{"code":-32603,"data":{"code":-32000,"message":"transaction underpriced"}}}'

What gives?

At the end of this first loop, my @GranaryFinance settles to these positions.

After 5

... GLORIOUS ...

loops, ...

Beethoven, part deux

As you can see, this LP is unbalanced, leaning on the $sFTMX-side.

So, now, my positions settle to this.

Onto @UniDexFinance on @FantomFDN, which continues to post very strong returns.

The $FTM-pool has yields, so I collect them,

At the end of the day, my @UniDexFinance pools are up 85% overall,

Let's run the @FantomFDN daily report.

No comments:

Post a Comment